The quarterly planning spreadsheet told a clear story. Platform A dominated every metric: 40% lower cost, 25% faster deployment, perfect technical specifications. The recommendation seemed obvious.

But something felt wrong.

Years of building scalable systems had taught me to listen when experience whispered warnings that data couldn't capture. The vendor's demo was polished, yet subtle inconsistencies in their technical responses raised flags that wouldn't appear in any analysis. Integration complexity seemed understated. Support details felt vague.

Three months in, Platform A's hidden complexity doubled our project timeline. It was a perfect example of when analytical certainty misses implementation reality.

This tension between data-driven analysis and experiential wisdom sits at the heart of strategic decision-making. The question isn't whether to trust your spreadsheet or your intuition. It's learning how to integrate both effectively.

Why Perfect Data Doesn't Guarantee Perfect Decisions

Data-driven decision-making has transformed how organisations approach strategic choices. Organizations that make data-driven decisions systematically outperform competitors in both decision quality and business outcomes. Data provides objectivity, reduces bias, and creates confidence.

Yet strategic decisions often require insights that can't be captured in spreadsheets. McKinsey research reveals that decision-making preferences range from strong intuitive preference to exhaustive analytical deliberation. Their analysis of nearly 5,000 business leaders identified distinct decision-making archetypes, highlighting that successful strategic choices often require balancing analytical rigor with pattern recognition and experiential wisdom.

The most sophisticated analysis captures what can be measured, but strategic decisions often hinge on factors that don't translate into spreadsheet cells. Team dynamics, stakeholder relationships, cultural fit, and implementation complexity create real consequences that traditional metrics struggle to quantify.

Market conditions change faster than analysis cycles. Time constraints in fast-moving environments limit analytical completeness. When you have two weeks to decide on a platform that will define three years of development, perfect analysis becomes the enemy of good decisions.

Understanding Strategic Intuition

Intuition isn't mystical insight. At its best, intuition is powerful pattern recognition (something human brains are wired to do). When experienced leaders sense something doesn't feel right about a strategic direction, they're often synthesising complex information patterns that haven't been fully captured in conscious analysis.

According to research by Laura Huang, an associate professor of business administration at Harvard Business School, gut feelings can be useful in highly uncertain circumstances where further data gathering won't sway the decision maker. Based on extensive research across high-stakes decisions, Huang found that intuitive decision-making often inspires leaders to make critical calls, particularly in risky scenarios involving surgeons in emergency rooms or early-stage investors allocating millions in startup capital.

When Intuition Works and When It Doesn't

Intuition excels in complex stakeholder scenarios where relationship dynamics, cultural factors, and implementation challenges create success or failure conditions that don't appear in technical specifications. Risk assessment represents another area where intuitive pattern recognition provides valuable input when potential downside consequences are severe.

Strategic intuition becomes unreliable when applied outside your domain expertise. Personal bias represents another significant limitation. When you have strong emotional investment in a particular outcome, intuitive insights may reflect wishful thinking rather than genuine pattern recognition.

Situations requiring technical precision also favour analytical approaches. Regulatory compliance, financial calculations, and safety-critical decisions need quantitative rigour that intuitive assessments can't provide.

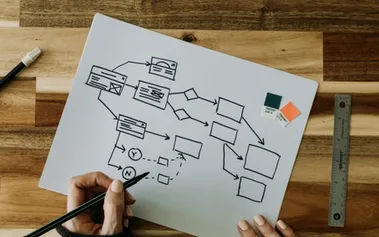

A Framework for Integration

The most effective strategic decision-making integrates analytical rigor with experiential wisdom rather than choosing between them. Research from MIT Sloan Management Review reveals this complexity: in a survey of 3,225 executives, 38% make decisions more rooted in intuition, 27% rely more on data, and 35% are equally split, highlighting that there's no emergent best practice.

The Three-Lens Decision Process

Lens 1: The Analytical Foundation Begin with comprehensive data analysis capturing quantifiable factors. Ask critical questions: What assumptions underpin these conclusions? Which factors resist measurement but might be significant? The analytical foundation provides essential context whilst acknowledging its limitations.

Lens 2: The Intuitive Signal Examine your intuitive responses to analytical recommendations. What pattern recognition triggers concern or confidence? Which previous experiences feel relevant? Pay attention to persistent concerns that don't disappear with additional analysis.

Lens 3: The Integration Question Identify where analysis and intuition align or conflict. When both perspectives point in the same direction, proceed with increased confidence. When they diverge, investigate the source of conflict before making final decisions.

Testing Intuitive Concerns

When intuitive concerns contradict analytical recommendations, create rapid, low-cost validation methods. Reference calls, pilot implementations, or scenario planning can test whether concerns reflect genuine risks or unfounded anxiety. Build validation into your decision timeline rather than treating it as delay.

Making This Work in Practice

Effective integration requires team processes that value both analytical rigor and experiential wisdom. Train leadership teams to think in both analytical and intuitive terms during strategic discussions. Create space for team members to surface pattern recognition insights that might not be immediately obvious.

Create psychological safety for questioning analytical recommendations based on experiential wisdom. When someone with relevant domain expertise expresses concern about a direction that looks good on paper, investigate their reasoning rather than dismissing it.

Document both analytical reasoning and qualitative insights that influence strategic choices. Track decision outcomes to improve both analytical and intuitive capability over time. When decisions succeed or fail, examine whether better analysis or more attention to intuitive concerns would have improved outcomes.

Moving Forward

Strategic excellence emerges from leaders who integrate analytical capability with experiential wisdom rather than viewing them as competing approaches. The spreadsheet provides essential foundation, but intuition often identifies the factors that determine implementation success or failure.

Evaluate your recent strategic decisions through both lenses. Where might better integration have improved outcomes? Build integration frameworks into your existing decision-making processes rather than treating this as additional overhead.

The goal isn't perfect decisions but better decisions that leverage all available intelligence. When your intuition contradicts the spreadsheet, you're not facing a problem to be solved but an opportunity to be explored. Both perspectives may be right about different aspects of the same complex strategic choice.

Strategic leadership means becoming comfortable with this complexity rather than seeking the false certainty of purely analytical or purely intuitive approaches. The most effective decisions emerge when data and experience inform each other, creating strategic insights that neither perspective could generate alone.