Two fintech companies enter the rapidly growing crypto payment space. Company A, focused purely on immediate profit and rapid expansion, builds their platform by stringing together multiple payment providers with fragile compliance implementations. Leadership prioritises speed over stability, constantly pivoting to capture new opportunities without considering long-term strategic implications or building reliable foundations.

Company B takes a different approach. They invest time in understanding regulatory requirements, design robust architecture that can scale sustainably, and build genuine partnerships with carefully vetted payment providers. Their compliance framework anticipates regulatory changes rather than reacting to them.

Six months later, Company A's aggressive growth strategy has collapsed into constant crisis management. Their fragmented system requires continuous last-minute recovery efforts, compliance backfilling consumes development resources, and customer complaints mount as service reliability deteriorates. Employee burnout from perpetual firefighting leads to key talent departures, further destabilising operations.

Company B has built a reputation for reliability that attracts enterprise clients seeking stable, compliant payment solutions. Their thoughtful architecture handles growth smoothly whilst their proactive compliance approach positions them advantageously as regulations evolve.

The difference isn't technical capability or market opportunity. It's strategic foresight. Company B invested in resilience as competitive infrastructure rather than viewing compliance and stability as obstacles to rapid growth.

Why Traditional Crisis Planning Fails Strategic Tests

The fundamental problem with most business continuity approaches is that they're designed around defensive thinking. Too many organisations either ignore crisis planning entirely or treat it as a necessary evil that drains resources without creating value. Both approaches miss the strategic potential of building genuine organisational resilience.

Leadership teams that view business continuity as pure expense create cultures where teams operate under unnecessary stress. Companies without proper backup systems force staff to work in perpetual high-stress mode. The finance manager who manually processes backup payment options because automated failover doesn't exist. The operations manager who can't take holiday because they're the only one who understands complex workarounds when systems fail.

Short-sighted leadership often views business continuity investment as unnecessary expense during good times, failing to recognise that disruption is inevitable. This reactive approach means playing catch-up during crises when decision-making is compromised by pressure. Emergency vendor contracts cost more than planned relationships. Crisis hiring to replace burnt-out staff costs far more than retaining resilient teams.

The biggest hidden cost is opportunity cost. Organisations without strategic resilience spend their energy on survival rather than advancement. They miss market opportunities because they're managing operational chaos whilst competitors capture market share.

The Strategic Resilience Framework

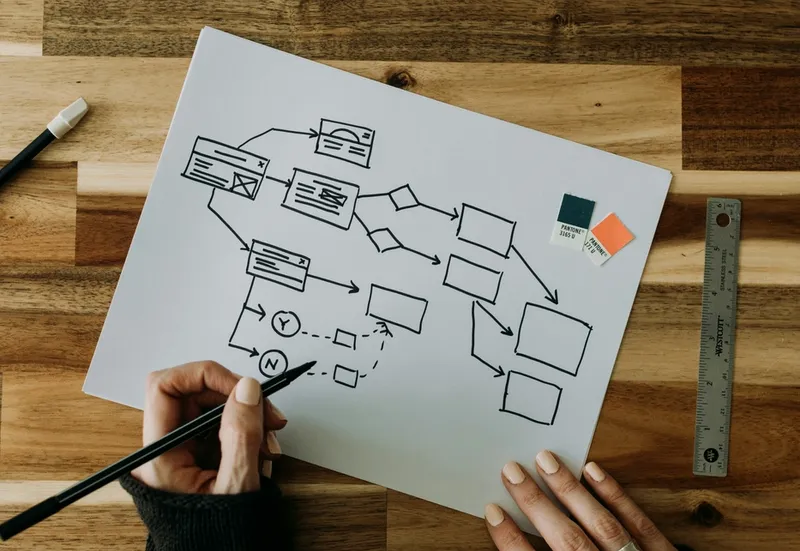

Strategic resilience represents a fundamental shift from defensive crisis management to proactive capability building. Instead of planning merely to survive disruption, strategic resilience means building systems that create competitive advantage during both normal operations and crisis situations.

This approach requires viewing every continuity investment through two lenses: how does this protect us during crisis, and how does this strengthen us during normal operations?

The Single Point of Failure Trap

One of the most dangerous strategic vulnerabilities organisations create is vendor lock-in disguised as operational efficiency. Single-vendor solutions seem streamlined until that vendor experiences problems, increases prices, or fails to innovate at the pace your business requires.

Companies that rely on single providers for critical services create both operational risk and competitive disadvantage. When your primary payment processor fails, your business stops. When your exclusive software vendor stagnates on innovation, your capabilities plateau.

According to Uptime Institute's 2024 analysis, 54% of organisations indicated that their most recent significant outage cost the organisation more than $100,000, with 16% reporting costs exceeding $1 million. Companies with multi-vendor failover capabilities maintained operations and gained market share whilst single-vendor competitors struggled to recover.

Multi-Vendor Strategy as Competitive Advantage

Strategic vendor diversification creates advantages that extend far beyond risk mitigation. Multiple vendor relationships provide negotiating power that single-vendor arrangements can't match. When providers know you have alternatives, they compete harder for your business through better pricing, service levels, and innovation access.

Multi-vendor strategies also provide earlier access to emerging technologies. Different vendors excel in different areas and innovate at different rates. You become an early adopter rather than a late follower.

Companies are increasingly being held accountable for the resilience of their third-party vendors. This creates opportunity for organisations that treat vendor assessment as competitive intelligence gathering.

The Four Pillars of Strategic Resilience

Strategic resilience rests on four foundational capabilities:

Adaptive Infrastructure involves systems designed for rapid scaling and multi-vendor failover. Your technology architecture supports both operational resilience and market opportunity response.

Dynamic Decision-Making uses data analysis to identify what crisis responses worked previously and applies that learning to both crisis planning and strategic decisions.

Distributed Stakeholder Ecosystem includes vendor relationships designed with resilience in mind across multiple providers. These relationships provide both operational redundancy and market intelligence.

Cultural Agility means teams trained for uncertainty as innovation capacity. People who adapt quickly during crises also adapt quickly to market opportunities.

Building Advantage Through Crisis Preparedness

The most sophisticated organisations understand that crisis preparedness reveals opportunities that wouldn't be visible during normal operations. When you stress-test your business model, you discover not just vulnerabilities but also potential new revenue streams and operational improvements.

EMA Research found that unplanned downtime now averages over $14,000 per minute, yet many organisations continue treating continuity planning as optional rather than strategic. Strategic resilience begins with using crisis scenarios to reveal market gaps and competitive weaknesses rather than just identifying risks.

The same analysis that identifies supply chain risks might reveal opportunities for vertical integration. Scenario planning for customer service disruption might uncover unmet needs in your market.

The most effective strategic resilience investments serve multiple purposes simultaneously. Remote collaboration infrastructure that ensures business continuity also enables access to global talent pools. Supply chain diversity that mitigates vendor risk also creates sourcing advantages.

Data systems designed for rapid decision-making under pressure also support faster strategic pivots during market opportunities. Communication frameworks that maintain stakeholder confidence during crises also strengthen customer relationships during normal operations.

Implementation Without Disruption

Building strategic resilience doesn't require massive upfront investments or disruptive organisational changes. The most effective approaches integrate resilience thinking into existing decision-making processes.

Gradual Diversification Strategy

Vendor diversification can happen gradually through phased implementation. When contracts come up for renewal, consider splitting services across multiple providers rather than automatically renewing with incumbent vendors. Build standardised integration approaches that work with multiple vendors.

Training programmes can develop crisis response and innovation skills simultaneously. Teams that learn to think adaptively during uncertainty become more innovative during normal operations.

Strategic Assessment and Implementation

Start by auditing your current business continuity planning through a strategic lens. Where could crisis preparedness become market differentiation? Which vendor relationships create single points of failure that also limit your competitive options?

Identify quick wins that demonstrate both resilience and competitive value. Perhaps diversifying your payment processing creates both operational redundancy and better transaction costs. Maybe developing remote customer service capabilities creates both crisis response and expanded market reach.

Success metrics should capture both defensive and offensive value. Measure not just risk mitigation, but also market position improvements, stakeholder confidence gains, and innovation velocity increases.

Recent Cockroach Labs research shows that whilst 95% of executives are aware of operational weaknesses that leave their organisations vulnerable, only 20% feel fully prepared to prevent or respond to outages. The companies that will dominate their markets aren't just those that survive crises, but those that use crisis preparedness to build capabilities that create sustainable competitive advantage.

When your backup plan becomes your growth plan, you've transformed from a company that reacts to disruption into one that leverages it. Strategic resilience isn't about expecting the worst. It's about being prepared for anything whilst building capabilities that help you succeed in everything.